Allianz: 6.3% Yield; Significant Upside Potential (ALIZY)

Devenorr/iStock via Getty Images

This article was coproduced with Dividend Sensei.

Warren Buffett is the greatest investor in history and famously said:

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

But thanks to this bear market, blue-chip bargains are raining from the sky like raindrops in a hurricane.

This means that wonderful companies are available at not just fair prices but wonderful prices. In fact, the world’s best insurance company, Allianz (OTCPK:ALIZY) today yields a very safe 6.3% AND trades at just 7.7X forward earnings.

Let me show you why Dividend Sensei just recommended ALIZY to Dividend Kings members and bought some more for his retirement portfolio.

Scared of a recession?

Sure, that could happen.

But guess what?

For long-term investors capable of looking beyond short-term fear, uncertainty, and doubt, NOW is the BEST POSSIBLE TIME to be buying blue-chip stocks like ALIZY.

According to Charlie Bilello of Compound Research, here’s what happens over the next 10 years, after stocks suffer one of their 20 worst 6-month periods (we just had the 11th).

-

buying stocks after a terrible 6 months historically results in 4% to 6% higher annual returns for the next decade

-

an average 281% 10-year total return = 14.3% CAGR = returns on par with the greatest investors in history

-

almost quadruple your money over the next decade

-

if you can stay calm and look beyond the short-term fear, uncertainty, and doubt or FUD

In other words, here are the four reasons to look beyond short-term recession fears and buy, buy, buy, now that it’s raining blue-chip bargains from the sky.

Reason One: Allianz Is The Complete High-Yield Package

Here is the bottom-line up front on Allianz

-

What You Need To Know About Foreign Dividend Withholding Taxes

-

Allianz is a German company, so US investors face 26.375% dividend withholding taxes on their shares

-

a tax credit recoups this if you fill out the paperwork and own them in taxable accounts

Reasons To Potentially Buy ALIZY Today

-

92% quality low-risk 12/13 Super SWAN insurance company

-

50th highest quality company on the Master List (90th percentile)

-

95% dividend safety score

-

1-year dividend growth streak (Frozen in the Pandemic, uninterrupted dividends cuts since 1890)

ALIZY has a policy of paying out 50% of earnings each year, with a goal of 5+% annual dividend growth.

As long as its capital ratio is above 150% (it’s over 199%), the dividend won’t be cut even if earnings fall.

Like CA banks, ALIZY might freeze the dividend in a crisis, but it doesn’t cut the dividend. It hasn’t missed a dividend payment since 1890 (not even during WWI or WWII).

-

6.3% very safe yield

-

0.5% average recession dividend cut risk

-

1.3% severe recession dividend cut risk

-

25% historically undervalued (potential strong buy)

-

Fair Value: $23.86 (10.3X earnings, 1.22 BV)

-

7.7X forward earnings and 0.92 BV

-

AA stable outlook credit rating = 0.51% 30-year bankruptcy risk

-

86th industry percentile risk management consensus = Very Good

-

4% to 8% CAGR margin-of-error growth consensus range

-

5% to 7% management growth guidance

-

9.2% CAGR median growth consensus

-

5-year consensus total return potential: 16% to 20% CAGR

-

base-case 5-year consensus return potential: 18% CAGR (3X more than the S&P consensus)

-

consensus 12-month total return forecast: 57%

-

Fundamentally Justified 12-Month Returns: 40% CAGR

Like most financials, ALIZY is down this year after a great start to the year. It was up 12% by mid-February due to rising interest rates helping financials.

-

Russian invasion caused it to fall off a cliff

-

and continues to weigh on the economic prospects of the EU

-

ALIZY gets 61% of sales from outside the EU

ALIZY Growth Thesis Remains Intact

|

Metric |

2021 Growth |

2022 Growth Consensus |

2023 Growth Consensus |

2024 Growth Consensus |

2025 Growth Consensus |

|

Sales |

-3% |

22% |

4% |

3% |

14% |

|

Dividend |

5% |

13% (Official) |

7% |

6% |

8% |

|

EPS |

-9% |

9% |

26% |

8% |

14% |

|

Book Value |

-7% |

-14% |

8% |

7% |

NA |

(Source: FAST Graphs, FactSet Research)

ALIZY’s expected to recover from the pandemic and generate much stronger earnings growth in the years to come and very healthy dividend growth.

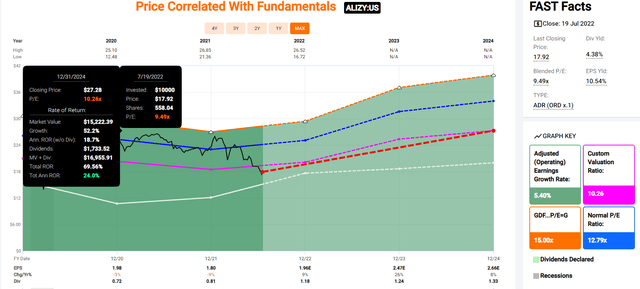

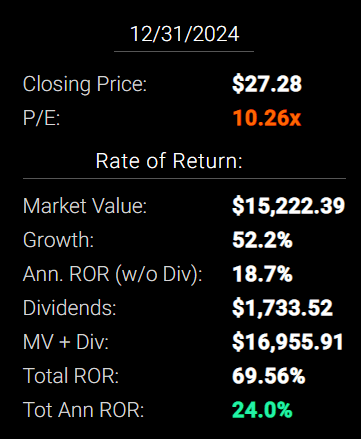

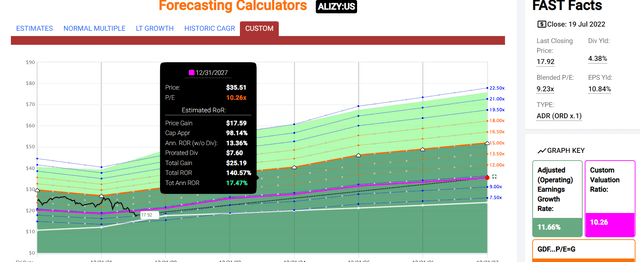

ALIZY 2024 Consensus Total Return Potential (10.26 Fair Value PE)

FAST Graphs FAST Graphs

If ALIZY grows as analysts expect by 2024 and returns to historical fair value, it could deliver 70% total returns or 24% annually.

-

Buffett-like return potential from an anti-bubble blue-chip hiding in plain sight

-

2X the S&P 500 consensus

Now compare that to the S&P 500 consensus.

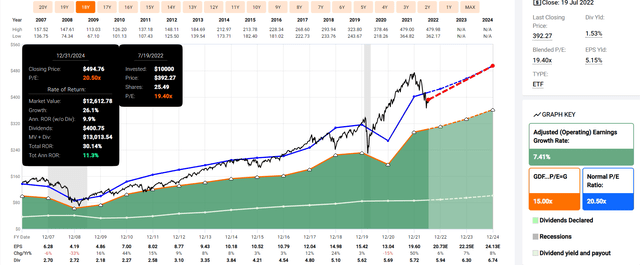

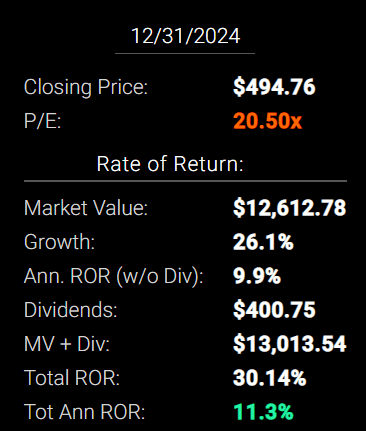

S&P 2024 Consensus Total Return Potential

FAST Graphs FAST Graphs

Analysts expect about 30% total returns or 11% annual returns from the S&P 500 over the next 2.5 years.

ALIZY 2027 Consensus Total Return Potential

FAST Graphs FAST Graphs

By 2027 if ALIZY grows as expected and returns to historical fair value, it could deliver 141% total returns or 18% annually.

-

about 3X more than the S&P 500 consensus

-

Buffett-like return potential from a high-yield blue-chip bargain hiding in plain sight

S&P 500 2027 Consensus Total Return Potential

|

Year |

Upside Potential By End of That Year |

Consensus CAGR Return Potential By End of That Year |

Probability-Weighted Return (Annualized) |

Inflation And Risk-Adjusted Expected Returns |

Expected Market Return Vs. Historical Inflation-Adjusted Return |

|

2027 |

55.46% |

9.23% |

6.92% |

4.82% |

70.88% |

(Source: Dividend Kings Market Valuation And Total Return Tool)

Analysts expect 55% total returns or 9.2% CAGR from the market over the next five years.

ALIZY Long-Term Consensus Total Return Potential (Ignoring Valuation Entirely, Cancels Out Over Time)

|

Investment Strategy |

Yield |

LT Consensus Growth |

LT Consensus Total Return Potential |

Long-Term Risk-Adjusted Expected Return |

Long-Term Inflation And Risk-Adjusted Expected Returns |

Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

|

Allianz Analyst Consensus |

6.3% |

9.20% |

15.5% |

10.9% |

8.4% |

8.6 |

2.24 |

|

Allianz (Management Guidance) |

6.3% |

6.0% |

12.3% |

8.6% |

6.1% |

11.7 |

1.81 |

|

Dividend Aristocrats |

2.6% |

8.6% |

11.2% |

7.8% |

5.4% |

13.4 |

1.69 |

|

S&P 500 |

1.7% |

8.5% |

10.2% |

7.1% |

4.7% |

15.4 |

1.58 |

|

Nasdaq |

1.0% |

12.7% |

13.7% |

9.6% |

7.1% |

10.1 |

1.99 |

(Sources: Morningstar, FactSet, Ycharts)

Management’s total return guidance is 12.3%, and analysts expect closer to 16% from ALIZY

-

far better than the lower yielding S&P and aristocrats

-

analysts think ALIZY can outperform the Nasdaq in the coming years

Inflation-Adjusted Consensus Return Potential: $1,000 Initial Investment (Ignoring Valuation)

|

Time Frame (Years) |

7.7% CAGR Inflation-Adjusted S&P Consensus |

8.7% Inflation-Adjusted Aristocrat Consensus |

9.8% CAGR Inflation-Adjusted ALIZY Guidance |

Difference Between Inflation-Adjusted ALIZY Guidance And S&P Consensus |

|

5 |

$1,451.05 |

$1,519.66 |

$1,598.10 |

$147.05 |

|

10 |

$2,105.56 |

$2,309.37 |

$2,553.93 |

$448.38 |

|

15 |

$3,055.27 |

$3,509.46 |

$4,081.45 |

$1,026.18 |

|

20 |

$4,433.36 |

$5,333.20 |

$6,522.58 |

$2,089.22 |

|

25 |

$6,433.04 |

$8,104.66 |

$10,423.76 |

$3,990.72 |

|

30 |

$9,334.69 |

$12,316.34 |

$16,658.26 |

$7,323.57 |

(Source: DK Research Terminal, FactSet)

Management says it can deliver potentially 17X inflation-adjusted returns over the long-term.

|

Time Frame (Years) |

Ratio ALIZY/Aristocrat Consensus |

Ratio Inflation-Adjusted ALIZY Guidance vs. S&P consensus |

|

5 |

1.05 |

1.10 |

|

10 |

1.11 |

1.21 |

|

15 |

1.16 |

1.34 |

|

20 |

1.22 |

1.47 |

|

25 |

1.29 |

1.62 |

|

30 |

1.35 |

1.78 |

(Source: DK Research Terminal, FactSet)

That’s potentially 1.8X the market’s return and 1.4X more than the dividend aristocrats.

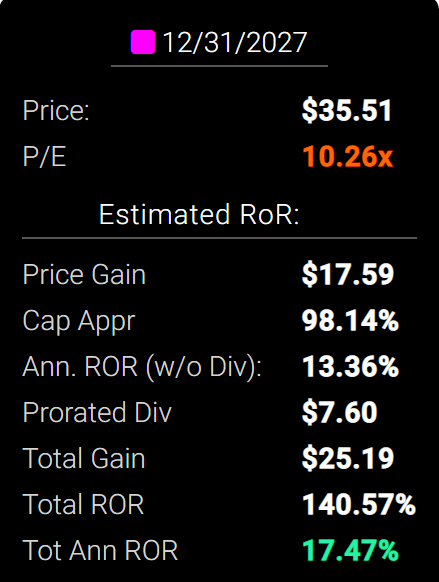

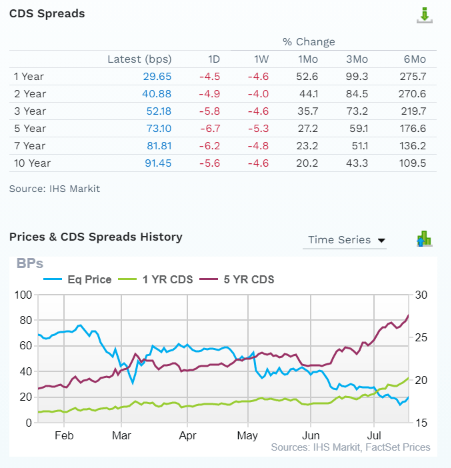

ALIZY Investment Decision Score

Dividend Kings

For anyone comfortable with its risk profile, ALIZY is one of the most reasonable and prudent high-yield aristocrats you can buy today.

-

25% discount vs 2% market discount = 23% better valuation

-

6.3% yield vs. 1.7% yield (and a much safer yield at that)

-

25% better long-term return guidance

-

50% better long-term return consensus

-

2X better risk-adjusted expected return over the next five years

-

42% of your investment repaid in consensus dividends within five years, almost 4X more than the S&P 500

Reason Two: The Highest Quality Insurance Company

There are many ways to measure safety and quality, and I factor in pretty much all of them.

The Dividend Kings’ overall quality scores are based on a 253-point model that includes:

-

Dividend safety

-

Balance sheet strength

-

Credit ratings

-

Credit default swap medium-term bankruptcy risk data

-

Short and long-term bankruptcy risk

-

Accounting and corporate fraud risk

-

Profitability and business model

-

Growth consensus estimates

-

Management growth guidance

-

Historical earnings growth rates

-

Historical cash flow growth rates

-

Historical dividend growth rates

-

Historical sales growth rates

-

Cost of capital

-

GF Scores

-

Long-term risk-management scores from MSCI, Morningstar, FactSet, S&P, Reuters’/Refinitiv, and Just Capital

-

Management quality

-

Dividend-friendly corporate culture/income dependability

-

Long-term total returns (a Ben Graham sign of quality)

-

Analyst consensus long-term return potential

In fact, it includes over 1,000 fundamental metrics, including the 12 rating agencies we use to assess fundamental risk.

-

credit and risk management ratings make up 41% of the DK safety, and quality model

-

dividend/balance sheet/risk ratings make up 82% of the DK safety and quality model

How do we know that our safety and quality model works well?

During the two worst recessions in 75 years, our safety model 87% of blue-chip dividend cuts, the ultimate baptism by fire for any dividend safety model.

How does ALIZY score on our comprehensive safety and quality models?

ALIZY Dividend Safety

|

Rating |

Dividend Kings Safety Score (162 Point Safety Model) |

Approximate Dividend Cut Risk (Average Recession) |

Approximate Dividend Cut Risk In Pandemic Level Recession |

|

1 – unsafe |

0% to 20% |

over 4% |

16+% |

|

2- below average |

21% to 40% |

over 2% |

8% to 16% |

|

3 – average |

41% to 60% |

2% |

4% to 8% |

|

4 – safe |

61% to 80% |

1% |

2% to 4% |

|

5- very safe |

81% to 100% |

0.5% |

1% to 2% |

|

ALIZY |

95% |

0.50% |

1.30% |

|

Risk Rating |

Low-Risk (86th industry percentile risk-management consensus) |

AA stable outlook credit rating 0.51% 30-year bankruptcy risk |

15% OR LESS Max Risk Cap Recommendation |

Long-Term Dependability

|

Company |

DK Long-Term Dependability Score |

Interpretation |

Points |

|

Non-Dependable Companies |

21% or below |

Poor Dependability |

1 |

|

Low Dependability Companies |

22% to 60% |

Below-Average Dependability |

2 |

|

S&P 500/Industry Average |

61% (61% to 70% range) |

Average Dependability |

3 |

|

Above-Average |

71% to 80% |

Very Dependable |

4 |

|

Very Good |

81% or higher |

Exceptional Dependability |

5 |

|

ALIZY |

91% |

Exceptional Dependability |

5 |

Overall Quality

|

ALIZY |

Final Score |

Rating |

|

Safety |

95% |

5/5 very safe |

|

Business Model |

70% |

2/3 above-average |

|

Dependability |

91% |

5/5 exceptional |

|

Total |

92% |

12/13 Super SWAN |

|

Risk Rating |

3/3 Low-Risk |

|

|

15% OR LESS Max Risk Cap Rec |

10% Margin of Safety For A Potentially Good Buy |

ALIZY is the 50th highest quality company on the DK 500 Master list.

How significant is this? The DK 500 Master List is one of the world’s best watchlists, including:

-

every dividend aristocrat (S&P companies with 25+ year dividend growth streaks)

-

every dividend champion (every company, including foreign, with 25+ year dividend growth streaks)

-

every dividend king (every company with 50+ year dividend growth streaks)

-

every foreign aristocrat (every company with 20+ year dividend growth streaks)

-

every Ultra SWAN (wide moat aristocrats, as close to perfect quality companies as exist)

-

40 of the world’s best growth stocks

In other words, even among the world’s best companies, ALIZY is higher quality than 90% of them.

Why I Trust Allianz And So Can You

-

A deep dive look into ALIZY’s business model

Here’s the summary of the investment thesis and an update on how things are going.

-

Allianz was founded in 1890 in Munich, Germany

-

it’s been paying annual dividends without fail since 1890

-

rating agencies (and Morningstar, Sebastian Wolf, and I) consider ALIZY the best-run and safest insurance company on earth

With 120 million global customers, Allianz is the largest insurance company with industry-leading market share and trust

-

#1 market share

-

#1 brand

-

#1 financial strength according to rating agencies

-

#1 in dividend payouts

-

an industry leader in risk-management (87th industry percentile)

-

Allianz owns shares in virtually all German companies and is a proxy for the German stock market

ALIZY is the world’s largest insurance company and, according to rating agencies, the safest.

Management thinks it can generate 5% to 7% growth over time and thus 11.3% to 13.3% CAGR long-term total returns.

I’m hardly the only analyst singing ALIZY’s praises.

“Allianz Is Our Top Pick in Insurance

We are adding Allianz to the Best Ideas list with a EUR 210 fair value estimate; the shares are currently trading in 4-star territory.

Concerns around inflation and travel insurance have also resulted in a bit of a hangover on the price of its shares. While we went through the events surrounding the collapse of the Structured Alpha Funds we were frequently shocked by the turns of events, but we believe the outcome is relatively settled and contained.

Our belief is that it is the Allianz Global Investors U.S. mutual funds that have been affected by the ban by the Securities and Exchange Commission, and this will lead to a less than EUR 500 million reduction in fees.

While we are concerned about inflation, we have incorporated a deterioration in underwriting with a lagged improvement in pricing, and we think the disruption in travel will improve.” – Morningstar

Morningstar loves ALIZY, calling it their favorite insurance company. So does my fellow Dividend King Sebastian Wolf, our EU blue-chip expert.

I also consider it my favorite insurance company

Why is ALIZY so wonderful?

“Our broader view is that Allianz is one of the highest-quality names in our European insurance coverage. While this is aided by the Pimco franchise, Allianz also has a good record of financial discipline and capital allocation. Beyond the isolated events of the Structured Alpha Funds, the business has a top-tier management team, and given the size of the business, we have always been impressed by the quality of its underwriting.” – Morningstar

Exceptional management and exceptional risk-management.

Allianz Is Insurance Done Write

ALIZY’s combined ratio (losses/premiums) was 96% in the Pandemic, 93.8% in 2021, and is expected to fall to 92.6% in 2025.

Since 2000 the average combined ratio for US insurance companies was 106%.

-

most US insurance companies lose 6% on policies

-

and survive by investing insurance float and earning 6+% returns

What about ALIZY’s average combined ratio? Since 2008 it was 95.4%.

-

The US insurance industry has seen a combined ratio of over 100% in 11 out of the last 20 years

-

ALIZY hasn’t had a combined ratio above 100% since the Great Recession

-

ALIZY earns an average of 4.6% profit on its policies

-

10.6% higher profitability/policy than US insurance companies

ALIZY’s solvency ratio is 199% vs. 100% regulatory requirements and management’s 150% minimum for maintaining dividend safety.

ALIZY’s solvency ratio has averaged 215% over the last seven years, including the Pandemic crash.

-

180% is management’s official target solvency ratio policy

ALIZY’s portfolio (float) is conservatively invested.

-

83% bonds

-

18% AAA bonds

-

64% A-rated bonds

-

92% investment grade bonds

-

12% stocks

-

2% real estate

This is truly a fortress balance sheet high-yield investors can trust.

ALIZY’s world-class world management involves stress testing how its solvency ratio and shareholder equity would react to various conditions.

Here’s what management estimates in terms of solvency ratio changes:

-

if the global stock market falls 30%, the solvency ratio falls 16% (to 183%)

-

if the global stock market rises 30%, the solvency rises 13% (to 212%)

-

if interest rates rise 0.5% solvency rises 2% (to 201%)

-

if interest rates fall 0.5% solvency falls 4% (to 195%)

-

if credit spreads on government bonds widen by 0.5% (due to global recession), solvency falls 9% to 190%

-

if credit spreads on government bonds fall by 0.5%, solvency rises by 1% to 200%

Bottom line: ALIZY is a fortress insurance company that will almost certainly keep paying its generous and growing dividend in all economic and market conditions.

Quantitative Analysis: The Math Backing Up The Investment Thesis

Ben Graham recommended combining qualitative (the story) analysis with quantitative analysis looking at the past, present, and likely future.

ALIZY Credit Ratings

|

Rating Agency |

Credit Rating |

30-Year Default/Bankruptcy Risk |

Chance of Losing 100% Of Your Investment 1 In |

|

S&P |

AA Stable Outlook |

0.51% |

196.1 |

|

Fitch |

AA- Stable Outlook |

0.55% |

181.8 |

|

Moody’s |

A+ (A+ equivalent) Stable Outlook |

0.60% |

166.7 |

|

AMBest |

Aa3 (AA- equivalent) Stable |

0.55% |

181.8 |

|

Consensus |

AA- Stable Outlo |

0.55% |

181.0 |

(Source: S&P, Fitch, AMBest, Moody’s)

4 rating agencies estimate ALIZY’s 30-year bankruptcy risk at 0.55%, or a 1 in 181 chance that investors get wiped out over the next three decades.

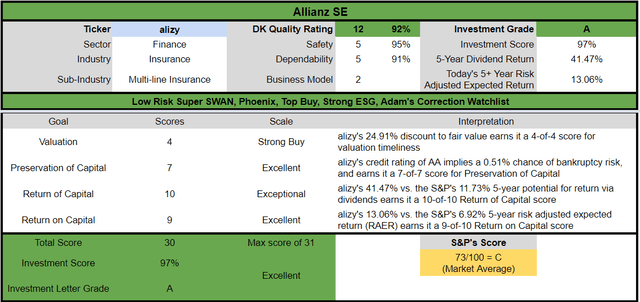

ALIZY Credit Default SWAPs: Real-Time Fundamental Risk Analysis From The Bond Market

(Source: FactSet Research Terminal)

Credit default SWAPs are the insurance policies bond investors take out against default.

-

they represent real-time fundamental risk assessment from the “smart money” on Wall Street

-

ALIZY’s fundamental risk has increased significantly over the last 6 months since the Russian invasion of Ukraine

-

the bond market is pricing in a 2.74% 30-year default risk, which is consistent with an A- stable credit rating

-

basically, management, analysts, rating agencies, and the bond market all agree

-

ALIZY’s thesis is intact

-

19 analysts, 8 rating agencies, and the bond market make up our ALIZY expert consensus

-

27 expert consensus + the bond market monitoring ALIZY’s risk profile

-

how we track fundamental risk in real-time

-

to ensure high-probability/low-risk investment recommendations

ALIZY Profitability: Wall Street’s Favorite Quality Proxy

ALIZY’s profitability is historically in the top 30% of financials

-

a narrow moat insurance company bordering on wide moat

ALIZY Trailing 12-Month Profitability Vs. Peers

|

Metric |

TTM |

Industry Percentile |

Major Insurance Companies More Profitable Than ALIZY (Out Of 512) |

|

Net Margin |

3.98% |

37.33 |

321 |

|

Return On Equity |

5.94% |

35.64 |

330 |

|

Return On Assets |

0.42% |

26.37 |

377 |

|

Returns On Invested Capital |

0.55% |

24.3 |

388 |

|

Average |

2.72% |

30.91 |

354 |

(Source: GuruFocus Premium)

Due to many more claims in the last year, partially due to the war, ALIZY’s profitability has fallen to the 31st percentile in the last 12 months.

Over the past 20 years, ALIZY’s profitability, specifically its net profit margin, has been relatively stable outside of this war.

-

confirming the stability of its narrow moat

ALIZY Profit Margin Consensus Forecast

|

Year |

EBIT (Operating) Margin |

Net Margin |

|

2020 |

7.7% |

4.8% |

|

2021 |

9.0% |

4.5% |

|

2022 |

8.9% |

5.0% |

|

2023 |

9.1% |

6.1% |

|

2024 |

9.2% |

6.2% |

|

2025 |

9.3% |

6.1% |

|

Annualized Growth |

3.98% |

4.85% |

|

Annualized Growth (Post Pandemic) |

0.76% |

8.37% |

(Source: FactSet Research Terminal)

Analysts expect a recovery to pre-war and pre-pandemic margins within a few years.

Reason Three: Stronger Growth Prospects Thanks To Rising Global Interest Rates

ALIZY has been able to grow steadily at 4% even with negative interest rates around most of the world. What happens when interest rates rise to sane levels?

Just take a look at what analysts expect.

ALIZY Medium-Term Growth Consensus Forecast

|

Year |

Sales |

EBIT (Operating Income) |

Net Income |

|

2020 |

$170,384 |

$13,038 |

$8,255 |

|

2021 |

$168,822 |

$15,234 |

$7,515 |

|

2022 |

$158,666 |

$14,098 |

$7,943 |

|

2023 |

$164,237 |

$14,932 |

$10,006 |

|

2024 |

$170,451 |

$15,612 |

$10,491 |

|

2025 |

$193,997 |

$18,045 |

$11,910 |

|

Annualized Growth |

2.63% |

6.72% |

7.61% |

|

Annualized Growth (Post Pandemic) |

3.54% |

4.32% |

12.20% |

|

Cumulative Over The Next 4 Years |

$687,351 |

$62,687 |

$40,350 |

(Source: FactSet Research Terminal)

Ignoring the pandemic, ALIZY is expected to grow sales at 3.5% and its net income by a much more impressive 12% annually.

$40 billion in cumulative consensus earnings over the next four years.

ALIZY Dividend Growth Consensus Forecast

|

Year |

Dividend Consensus |

EPS/Share Consensus |

EPS Payout Ratio |

Retained (Post-Dividend) Earnings |

Buyback Potential |

|

2022 |

$1.18 |

$2.06 |

57.3% |

$3,592 |

4.98% |

|

2023 |

$1.26 |

$2.51 |

50.2% |

$5,103 |

7.07% |

|

2024 |

$1.33 |

$2.69 |

49.4% |

$5,552 |

7.69% |

|

2025 |

$1.44 |

$3.08 |

46.8% |

$6,694 |

9.27% |

|

Total 2022 Through 2025 |

$5.21 |

$10.34 |

50.4% |

$20,940.66 |

29.00% |

|

Annualized Rate |

6.86% |

14.35% |

-6.55% |

23.06% |

23.06% |

(Source: FactSet Research Terminal)

50% is the safe payout ratio for this industry, according to rating agencies.

-

management’s policy is to pay out 50% of earnings over time

-

targeting 5+% dividend growth each year

-

and not cut the dividend unless the solvency ratio falls under 150%

-

57% in 2022 due to the war

-

but falling to 47% by 2025 despite 7% annual dividend growth

-

14% EPS growth

-

$21 billion in post-dividend retained earnings

-

enough to buy back 29% of shares at current valuations if management wanted to

ALIZY Buyback Consensus Forecast

|

Year |

Consensus Buybacks ($ Millions) |

% Of Shares (At Current Valuations) |

Market Cap |

|

2022 |

$1,452 |

2.0% |

$72,044 |

|

2023 |

$1,965 |

2.7% |

$72,044 |

|

2024 |

$1,965 |

2.7% |

$72,044 |

|

2025 |

$3,389 |

4.7% |

$72,044 |

|

Total 2022-2025 |

$8,771 |

12.2% |

$72,044 |

|

Annualized Rate |

3.20% |

Average Annual Buybacks |

$2,193 |

(Source: FactSet Research Terminal)

Analysts expect an average of $2.2 billion in annual buybacks totally of $8.8 billion over the next four years. That’s enough to buy back 12.2% of shares at current valuations, or 3.2% per year.

ALIZY began its current buyback policy in 2017 and since then has averaged 2.0% annual net repurchases of its stock.

|

Time Frame (Years) |

Net Buyback Rate |

Shares Remaining |

Net Shares Repurchased |

Each Share You Own Is Worth X Times More (Not Including Future Growth And Dividends) |

|

5 |

2.0% |

90.62% |

9.38% |

1.10 |

|

10 |

2.0% |

82.13% |

17.87% |

1.22 |

|

15 |

2.0% |

74.42% |

25.58% |

1.34 |

|

20 |

2.0% |

67.45% |

32.55% |

1.48 |

|

25 |

2.0% |

61.12% |

38.88% |

1.64 |

|

30 |

2.0% |

55.39% |

44.61% |

1.81 |

(Source: FactSet, YCharts)

IF ALIZY continues its historical buyback rate for the next 30 years, it could repurchase 45% of its shares, increasing the intrinsic value of your shares by 81%.

-

not counting future cash flow and dividend growth

ALIZY Long-Term Growth Outlook

-

9.2% to 16.9% growth consensus range (five sources)

-

the median consensus from all 19 analysts is 9.2%

-

management growth guidance is 5% to 7% CAGR

-

I use 20% margins of error and just management’s guidance to estimate a 4% to 8% likely growth rate for ALIZY.

-

2010 to 2019 growth rate (Zero Rate World, Post GFC, Pre-Pandemic): 3.9% CAGR

Why are analysts so bullish on ALIZY’s growth prospects? Because of rising global interest rates.

-

insurance float is free

-

net yield on float portfolio is determined primarily by global interest rates

-

a rise in global rates is pure profit

In 2020 ALIZY’s net yield was 2.8%.

-

it’s expected to rise to 3.0% by 2023

-

and 3.2% in 2024

Or, to put it another way, ALIZY is expected to average 7.5% net profits on its policies PLUS 3.2% on the float.

This is the world’s largest and safest insurance company, and it was able to grow earnings at 4% with interest rates at zero. Now rates are much higher, and analysts think ALIZY’s EPS will soar.

Reason Four: A Wonderful Company At A Wonderful Price

For some reason, ALIZY’s historical data doesn’t go back beyond 2021 in FAST Graphs, YCharts, or Portfolio Visualizer.

So to estimate its market-determined historical fair value, I’m using:

-

13-year median price/book value

-

5-year average yield

-

13-year median yield

DK uses a harmonic average of all our fair value estimates.

-

smooths out outliers

-

and overweight the lower estimates for conservatism

|

Metric |

Historical Fair Value Multiples (all-years) |

2021 |

2022 |

2023 |

2024 |

12-Month Forward Fair Value |

|

5-Year Average Yield |

4.58% |

$26.64 |

$24.78 |

$24.78 |

$29.04 |

|

|

13-Year Median Yield |

4.40% |

$27.73 |

$25.80 |

$25.80 |

$30.23 |

|

|

13-Year Median Book Value |

1.10 |

$23.99 |

$20.57 |

$22.21 |

$23.67 |

|

|

Average |

$26.02 |

$23.49 |

$24.17 |

$27.33 |

$23.86 |

|

|

Current Price |

$17.92 |

|||||

|

Discount To Fair Value |

31.13% |

23.70% |

25.84% |

34.44% |

24.91% |

|

|

Upside To Fair Value (NOT Including Dividends) |

45.21% |

31.06% |

34.85% |

52.52% |

33.17% (40% including dividend) |

|

|

2022 BVPS |

2023 BVPS |

2022 Weighted EPS |

2023 Weighted EPS |

12-Month Forward EPS |

12-Month Average Fair Value Forward PBV |

Current Forward PBV |

|

$18.70 |

$20.19 |

$8.27 |

$11.26 |

$19.53 |

1.22 (10.26 PE) |

0.92 (7.7 PE) |

I estimate ALIZY is historically worth about 1.22X book value.

-

Berkshire’s (BRK.A) (BRK.B) historical book value is 1.35, and its trades at 1.23 today

That

works out to a historical fair value PE of 10.26X vs. 7.7X today.

-

ALIZY is an anti-bubble blue-chip bargain hiding in plain sight

|

Analyst Median 12-Month Price Target |

Morningstar Fair Value Estimate |

|

$26.03 (1.33 BV, 11.2 PE) |

$22.40 (1.15 BV and 9.6 PE) |

|

Discount To Price Target (Not A Fair Value Estimate) |

Discount To Fair Value |

|

31.16% |

20.00% |

|

Upside To Price Target (Not Including Dividend) |

Upside To Fair Value (Not Including Dividend) |

|

45.26% |

25.00% |

|

12-Month Median Total Return Price (Including Dividend) |

Fair Value + 12-Month Dividend |

|

$27.17 |

$23.54 |

|

Discount To Total Price Target (Not A Fair Value Estimate) |

Discount To Fair Value + 12-Month Dividend |

|

34.03% |

23.86% |

|

Upside To Price Target (Including Dividend) |

Upside To Fair Value + Dividend |

|

51.76% |

31.33% |

Morningstar’s fair value estimate implies ALIZY is worth 1.15 BV and 9.6X earnings and 31% upside to fair value.

Analysts expect 1.33 BV and 11.2 PE within 12 months, a 52% total return.

I estimate ALIZY’s fundamentals justify up to a 40% total return in the next year.

-

if it returns to historical fair value and grows as expected over the next 12 months

I don’t recommend companies based on 12-month forecasts but on the margin of safety and whether or not it sufficiently compensates you for a company’s risk profile.

Margin Of Safety Not 12-Month Price Targets Are How I Make Investment Recommendations

|

Rating |

Margin Of Safety For Low-Risk 12/13 Super SWAN quality companies |

2022 Fair Value Price |

2023 Fair Value Price |

12-Month Forward Fair Value |

|

Potentially Reasonable Buy |

0% |

$23.49 |

$24.17 |

$23.86 |

|

Potentially Good Buy |

10% |

$21.14 |

$21.75 |

$21.48 |

|

Potentially Strong Buy |

20% |

$18.79 |

$19.33 |

$19.09 |

|

Potentially Very Strong Buy |

30% |

$14.80 |

$16.92 |

$16.71 |

|

Potentially Ultra-Value Buy |

40% |

$14.09 |

$14.50 |

$14.32 |

|

Currently |

$17.92 |

23.70% |

25.84% |

24.91% |

|

Upside To Fair Value (Not Including Dividends) |

31.06% |

34.85% |

33.17% |

For anyone comfortable with its risk profile ALIZY is a potentially strong buy.

Risk Profile: Why Allianz Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

What Could Cause ALIZY’s Investment Thesis To Break

-

safety falls to 40% or less

-

balance sheet collapses (very unlikely, 0.55% probability according to rating agencies)

-

Europe plunges into a prolonged depression due to the war

-

triggering a global severe recession

-

growth outlook falls to less than 3.7% for six years

-

ALIZY’s role in my portfolio is to deliver long-term 10+% returns with minimal fundamental risk

-

8+% total return requirement for defensive sectors (including midstream)

-

10+% for non-defensive (cyclical) sectors like financials

How long it takes for a company’s investment thesis to break depends on the quality of the company.

|

Quality |

Years For The Thesis To Break Entirely |

|

Below-Average |

1 |

|

Average |

2 |

|

Above-Average |

3 |

|

Blue-Chip |

4 |

|

SWAN |

5 |

|

Super SWAN |

6 |

|

Ultra SWAN |

7 |

|

100% Quality Companies (MSFT, LOW, and MA) |

8 |

These are my personal rule of thumb for when to sell a stock if the investment thesis has broken. ALIZY is highly unlikely to suffer such catastrophic declines in fundamentals.

Risk Profile Summary

“We rate Allianz as having medium uncertainty.

The outcome of the rulings on the Structured Alpha Funds appears to be settled, and while there are number of known unknowns that relate to asset management and insurance, we think there is reasonable visibility on earnings and cash flows.

Further, we see good progress in Allianz’s capital allocation plans; barring the pandemic and SAF events, we like the operational reasoning behind these decisions and their returns.

Allianz Partners is probably one of the largest suppliers of travel insurance, and this industry is having operational trouble. After an economic slowdown from an already stretched economic environment under COVID-19 that was borne out of restrictions on travel, airport congestion is now the latest headwind to the travel industry that is likely to affect travel insurance claims as well as demand for this product.

We view this headwind as more transitory, though, and believe airlines will eventually right this dearth.” – Morningstar

ALIZY’s Risk Profile Includes

-

economic cyclicality risk: In the pandemic, earnings declined by 11%

-

economic risk in the EU caused by the war: high inflation is hurting profitability at the moment

-

regulatory risk: capital requirements mostly though Structured Alpha Fund scandal is another example of potentially high fines and a regulatory crackdown

-

talent retention risk in the tightest job market in 50 years

-

cyber-security risk: hackers and ransomware

-

currency risk: including the dividend

“Germany’s Allianz has agreed to pay about $6 billion, and its U.S. asset management unit will plead guilty to fraud after a group of its multi-billion investment funds collapsed amid market turmoil trigg

ered by the coronavirus pandemic in 2020.” – Insurance Journal

ALIZY has now set aside $5.6 billion to settle the collapse of its Structured Alpha funds.

“A dozen public pension funds and other institutional investors sued Allianz Global Investors in 2020 for alleged mismanagement of the enhanced-return strategy.

Plaintiffs, including the $21.2 billion Arkansas Teacher Retirement System, Little Rock; Raytheon Technologies Corp., Waltham, Mass.; the $4.9 billion Milwaukee City Employees’ Retirement System; and Blue Cross Blue Shield’s national employee benefits committee, claimed that Allianz GI abandoned its investment and risk management strategies and subjected investors to undisclosed risk that led to massive losses in February and March of 2020.” – Piononline

The collapse of these specialized derivatives-based products has left a black eye on ALIZY, which is famous for its conservativism and trustworthiness. Thus far, analysts and rating agencies don’t think it will materially affect the company’s long-term growth prospects.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Analysis: How Large Institutions Measure Total Risk

-

see the risk section of this video to get an in-depth view (and link to two reports) of how DK and big institutions measure long-term risk management by companies

ALIZY Long-Term Risk-Management Consensus

|

Rating Agency |

Industry Percentile |

Rating Agency Classification |

|

MSCI 37 Metric Model |

100.0% |

AAA Industry Leader, Stable Trend |

|

Morningstar/Sustainalytics 20 Metric Model |

91.6% |

16.7/100 Low-Risk |

|

Reuters’/Refinitiv 500+ Metric Model |

99.4% |

Excellent |

|

S&P 1,000+ Metric Model |

89.0% |

Excellent, Stable Trend |

|

FactSet |

50.0% |

Average, Negative Trend |

|

Morningstar Global Percentile (All 15,000 Rated Companies) |

86.2% |

Excellent |

|

Consensus |

86.0% |

Low-Risk, Very Good Risk-Management, Stable Trend |

(Sources: MSCI, Morningstar, FactSet, S&P, Reuters)

-

the most recent fallout from the Alpha Fund scandal has lowered ALIZY’s risk-management consensus from 87% to 86%

ALIZY’s Long-Term Risk Management Is The 21st Best In The Master List (96th Percentile)

|

Classification |

Average Consensus LT Risk-Management Industry Percentile |

Risk-Management Rating |

|

S&P Global (SPGI) #1 Risk Management In The Master List |

94 |

Exceptional |

|

Allianz |

86 |

Very Good |

|

Strong ESG Stocks |

78 |

Good – Bordering On Very Good |

|

Foreign Dividend Stocks |

75 |

Good |

|

Ultra SWANs |

71 |

Good |

|

Low Volatility Stocks |

68 |

Above-Average |

|

Dividend Aristocrats |

67 |

Above-Average |

|

Dividend Kings |

63 |

Above-Average |

|

Master List average |

62 |

Above-Average |

|

Hyper-Growth stocks |

61 |

Above-Average |

|

Monthly Dividend Stocks |

60 |

Above-Average |

|

Dividend Champions |

57 |

Average bordering on above-average |

(Source: DK Research Terminal)

ALIZY’s risk-management consensus is in the top 4% of the world’s highest quality companies and similar to that of such other blue-chips as

-

Colgate-Palmolive (CL) – dividend king Ultra SWAN

-

Ecolab (ECL) – dividend aristocrat Super SWAN

-

W. W. Grainger (GWW) – dividend king Ultra SWAN

-

AbbVie (ABBV) – dividend king Ultra SWAN

-

Lowe’s (LOW) – dividend king Ultra SWAN

-

Microsoft (MSFT) – Ultra SWAN

-

Prologis (PLD) – Super SWAN

-

Equinix (EQIX) – Ultra SWAN

-

BlackRock (BLK) – Ultra SWAN

-

Adobe (ADBE)

The bottom line is that all companies have risks, and ALIZY is very good at managing theirs.

How We Monitor ALIZY’s Risk Profile

-

19 analysts

-

4 credit rating agencies

-

8 total risk rating agencies

-

27 experts who collectively know this business better than anyone other than management

-

and the bond market for real-time fundamental risk updates

When the facts change, I change my mind. What do you do sir?” – John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: 6.3% Yielding Allianz Is The World’s Best-Run Insurance Company

Don’t get me wrong, I’m well aware that in the short-term, a potential recession in 2023 could send stocks lower by between 10% and 35%, depending on its severity.

Safety and quality, the SWANiness of a company, has nothing to do with short-term price volatility.

-

It has everything to do with fundamental risk (Buffett’s definition) and the safety of the dividend in all economic and market conditions

“Nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested.” – Peter Lynch

Research from Bank of America, JPMorgan, RIA, Princeton, and Fidelity explains why short-term timing is a fool’s errand.

-

in the short-term (1 year), luck is 33X as powerful as fundamentals

-

in the long-term (30+ years), fundamentals are 33X as powerful luck

Or, to put it another way, over a retirement time horizon, 97% of stock returns are driven by sales, earnings, cash flow, dividends, and nothing else.

I can’t tell you what the economy or market will do this year or even next year. But here’s what I can tell you about Allianz with high confidence.

-

ALIZY is one of the world’s safest, most dependable, and highest quality companies on earth

-

top 10% of the world’s best blue-chips

-

6.3% very safe and steadily growing yield expected to grow 7% over the next few years

-

12.3% CAGR long-term total return guidance, 1% more than aristocrats, and 2% more than the S&P 500

-

25% discount to fair value = potential strong buy

-

7.7X earnings and 0.92X book value

-

almost 150% consensus return potential over the next five years, 17% CAGR, about 3X more than the S&P 500

-

2X better risk-adjusted expected returns of the S&P 500 over the next five years with almost 4X higher consensus dividend income

Consider Allianz if you are looking for the world’s largest, safest, and best-run insurance company.

If you want a very safe 6.3% yield that is likely to grow at 5+% for the long-term from a company that hasn’t missed a dividend payment since 1890, Allianz might be right for you.

If you want to bend it like Buffett and buy one of the world’s safest high-yield anti-bubble “fat pitches,” then Allianz might be just what you’re looking for.

In the short-term, the stock market is a casino, with luck ruling 97% of the outcomes.

But guess what?

In the long-term?

Wall Street is ALSO a casino, driven by probabilities, and statistics, i.e. fundamentals.

In the long-term, the house always wins, and if you buy Allianz at today’s mouth-watering valuations, I’m 80% confident (the most any analyst can be on Wall Street) that you’ll be very pleased with the results in 5+ years.

Or, to put it another way, buy 6.3% yielding Allianz today, and you’ll likely feel like a stock market genius and earn Buffett-like returns over the next five years.

Helping you enjoy very safe, high, and growing yield while earning Buffett-like returns from blue-chip bargains hiding in plain sight is one of the goals of Dividend Kings and iREIT.

And when it comes to that goal, there are few better choices today than Allianz, the world’s best-run insurance company.