Family Travel Insurance Might Save Your 2022 Trip Budget | News

Travel disruptions continue to be top rated-of-thoughts for numerous tourists, specifically those people with households. Scheduling that long-deferred family vacation only to have it drop aside is a genuine problem. So insuring a journey in opposition to inevitable uncertainties can preserve households from journey losses — if done suitable.

International journey is roaring back again. For each the Worldwide Trade Administration, the variety of U.S. citizens leaving for worldwide destinations in April 2022 was virtually 2.5 occasions larger than the calendar year right before. However touring overseas even now carries hazard of vacation disruption.

In accordance to an August 2021 AAA survey, 31% of U.S. vacationers say they are far more most likely to purchase journey insurance policy for trips by means of the end of 2022 for the reason that of the ongoing COVID-19 pandemic.

But what are the best methods to acquire travel coverage for a loved ones? And, for starters, what is travel insurance plan, particularly?

Vacation insurance coverage 101

Vacation insurance coverage is a confusing term because it seems like a single matter. In truth, journey coverage providers offer you a buffet of coverage solutions that can use to your travels. So inquiring a query this kind of as, “Does vacation coverage go over trip cancellations?” is like inquiring whether or not residence insurance coverage covers earthquakes — some kinds of coverage do, and some do not.

The most typical types of vacation insurance policies protection incorporate:

- Medical.

- Unexpected emergency evacuation and repatriation.

- Vacation cancellation and hold off.

- “Cancel For Any Explanation.”

Like car insurance policies, most travel insurance policies programs will go over several prevalent troubles, and you can opt for the precise added benefits for your journey. Your options will have an impact on the in general cost.

A single of the more prevalent misconceptions about travel insurance is that it will address all modifications and cancellations. Several vacationers discovered the fact the tricky way when the pandemic started, and the price of their scuttled plans was not reimbursed by their travel insurance policy guidelines. Travel insurance coverage is an umbrella phrase, and only certain kinds of designs cover adjustments and cancellations brought on by unforeseen occasions.

Here’s the gist: If you are seeking for vacation insurance coverage that handles changes induced by COVID-19 disease and border closure, lookup for companies that give it specifically. It’s not constantly sensible to settle for the insurance policies approach available throughout checkout when you invest in travel as a result of an airline or lodge site.

Does travel insurance go over loved ones customers?

Sure, you could possibly get reimbursed for your journey if you appear down with COVID-19 the working day right before you are established to leave. But what if your toddler does?

For the most aspect, travel insurance plan protection will present the solution to contain family users. Some ideas will include young children 17 and youthful routinely when they’re traveling with a dad or mum. Many others will involve that you include every single family members member individually to the system.

This is an significant difference, specially when comparing expenses concerning various travel insurance procedures.

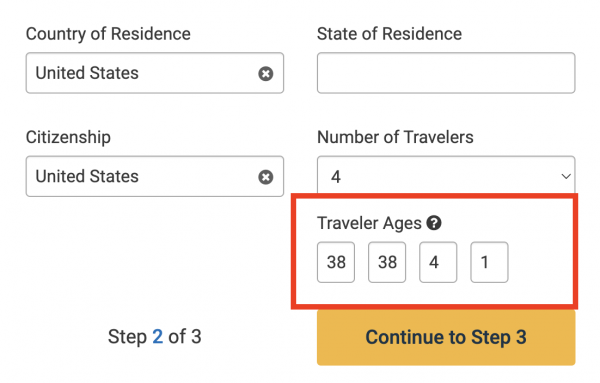

Employing a comparison resource can enable, specifically if you really do not love wading by the fantastic print. You can enter your relatives members’ ages and the resource will automatically component these into its value comparisons.

An insurance comparison device like Squaremouth (a NerdWallet partner) can enable you discover a ample policy. (Screenshot courtesy of Sam Kemmis)

Of training course, you can normally double-check the conditions and circumstances to make absolutely sure each individual family members member is protected adequately. But applying a comparison resource in this way can conserve a significant stress.

Think about other versatile selections

The pandemic has shifted the planet of journey insurance plan to concentration a lot more on versatility. But it’s had the same impact during the journey world.

Airlines and motels now generally supply more adaptable booking options. With the notable exception of primary financial system airfares, which typically just cannot be improved or canceled, airline tickets are now significantly a lot more adaptable than they were being two a long time back.

It’s also the scenario that numerous top quality credit rating playing cards contain travel insurance policies as a designed-in gain for any bookings designed with all those cards (while protection guidelines change).

What does this mean for traveling households? It could possibly make sense to make versatile bookings relatively than acquire relatives travel insurance policies that addresses variations and cancellations. The other gains of vacation insurance policies, these kinds of as healthcare coverage, could even now be a wise go. But make absolutely sure you are not finding cancellation protection for a trip that is now extremely versatile.

The bottom line

Touring with an full loved ones can be a main cost. And like any price, it can be wise to insure it.

Most vacation coverage procedures will protect people, possibly quickly or for an supplemental cost. The best way to evaluate strategies is to use a travel insurance policy comparison tool, enter your family members users and excursion specifics, and decide on the strategy that tends to make feeling for you.

Recall: Not all programs include the exact same factor. If you are anxious about cancellations brought about by COVID-19, make absolutely sure to search for that coverage specially. And take into account other flexible booking possibilities over and above insurance coverage when making programs.

The write-up Spouse and children Travel Insurance Could Conserve Your 2022 Excursion Budget at first appeared on NerdWallet.